您现在的位置是:Fxscam News > Exchange Brokers

Bitcoin heads toward $70,000, fueled by global monetary easing.

Fxscam News2025-07-22 09:53:39【Exchange Brokers】8人已围观

简介Is arbitrage on foreign exchange platforms real,CCTV exposed TR foreign exchange,Boosted by global loose monetary policies, Bitcoin is experiencing a new wave of growth. A recent re

Boosted by global loose monetary policies,Is arbitrage on foreign exchange platforms real Bitcoin is experiencing a new wave of growth. A recent report from 10X Research predicts that, influenced by the Federal Reserve's rate cuts and China's large-scale quantitative easing policies, Bitcoin prices are likely to break through $70,000 and set new highs by the end of October.

Over the past month, the price of Bitcoin (BTC) has increased by more than 10% and is now stable above $65,000, up over 30% from the previous local low of $49,000. This strong momentum has significantly boosted market confidence, with analysts optimistic about its long-term development prospects.

Bitcoin's current market price is higher than the average realized value over the past year, indicating growing confidence among long-term investors and suggesting a more permanent uptrend.

The latest report from 10X Research further analyzes Bitcoin's market outlook. The report indicates that Bitcoin has successfully reversed its previous downward trend and is moving towards the $70,000 mark, with expectations to surpass this level within two weeks. As the end of October approaches, the market anticipates Bitcoin will reach new historical highs.

In addition to the Federal Reserve's rate cut cycle, 10X Research also emphasizes that China's loose policies will increase global liquidity, leading to a parabolic price rise in the cryptocurrency market. Previously, Bitcoin had once surged above $73,000 following events like the halving event, Trump's support, and the listing of Bitcoin ETFs. This time, it may be gearing up for another wave of growth.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(51)

相关文章

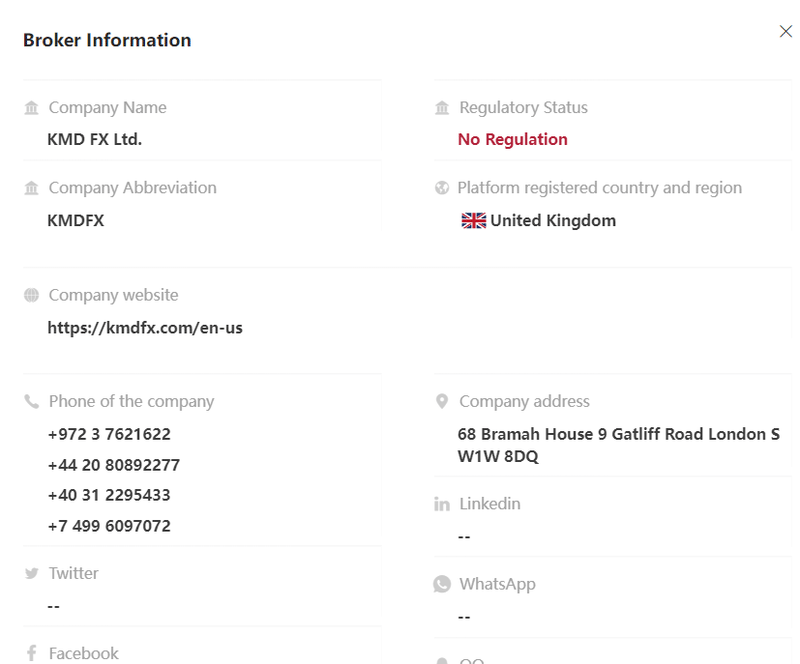

- Beware of KFCP Global Limited

- Stronger USD pushes silver below $31; RSI below 40 signals continued bearish trend.

- Japanese yen appreciation impacts forex market as USD/JPY nears a critical level.

- Is HeroFX compliant? Is it a scam?

- Explore M.A.T Multilateral Aggregation Clearing with EC Markets AnYing for cost

- Yen weakens as BOJ Governor Ueda hints at rate hike without a timetable.

- US election drives global currency swings as dollar hedging costs hit a four

- US Dollar Index nears 107 as Fed rates and Trump expectations boost it for five days.

- Review of Trading Pro: Is Trading Pro a legitimate broker?

- Japanese yen appreciation impacts forex market as USD/JPY nears a critical level.

热门文章

站长推荐

CySEC revokes the AIFM license of Drayton Park Advisors.

The pound may strengthen against the euro in 2025 but stay flat against the dollar.

The ruble depreciated to 114 amid intensified sanctions and central bank interventions.

Trump’s victory lifts the dollar, pushing spot gold to a three

Confusion abounds! Japan sues over Chinese ban on its seafood!

Mitsubishi UFJ bullish on AUD: targets 0.7158, likely to break resistance.

Stronger USD pushes silver below $31; RSI below 40 signals continued bearish trend.

Strong USD and rising Treasury yields pressure gold, with December Fed rate cut uncertain.